- MARKET AND COMPETITIVE

INTELLIGENCE - Consensus Analytics

- Competitive Intelligence

- Event Charts

- Institutional Holdings

- StockConferenceCalendar

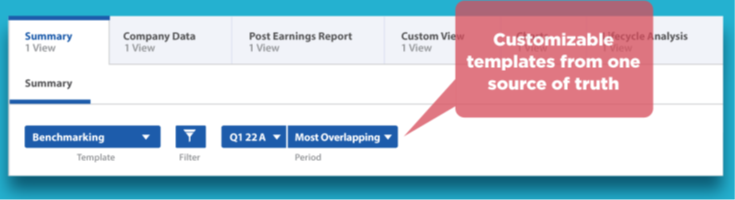

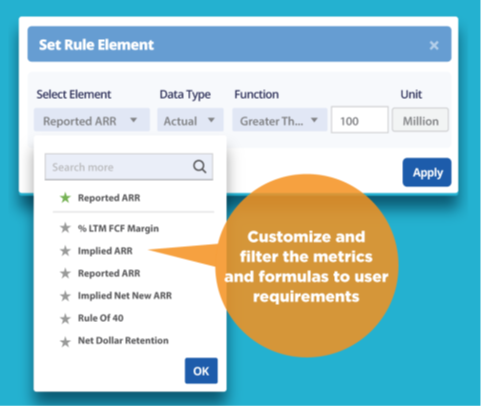

- SaaS Company Benchmarking

- FINANCIAL DATA, MODELING AND

FORECASTING - Financial Modeling and

Forecasting - Interactive Analyst Center

- CONTACT

- Virtua Research, Inc.

- 160 State Street, 8th Floor

- Boston, MA 02109

- (617)426.0900

- info[a]virtuaresearch.com

SAAS COMPANY POINT IN TIME BENCHMARKING & ANALYSIS