Internal forecast misalignment and risk

The Art and Science of Setting Guidance: An IR Team’s Balancing Act

Investor Relations teams wear many hats. They’re the company’s voice to investors and sell-side analysts, the internal detectives digging into numbers with finance and operations teams, and the storytellers who weave all this into a narrative that makes sense — even when the world around us doesn’t.

Getting the Basics Right: Internal Collaboration

It starts inside. The IR team leans heavily on finance, accounting, and ops to get a real-time sense of how the quarter is shaping up. This isn’t just about numbers on a spreadsheet — it’s about understanding the story behind those numbers, the KPIs that matter, and the subtle shifts that might signal something bigger.

Reading the Room: Market and Industry Context

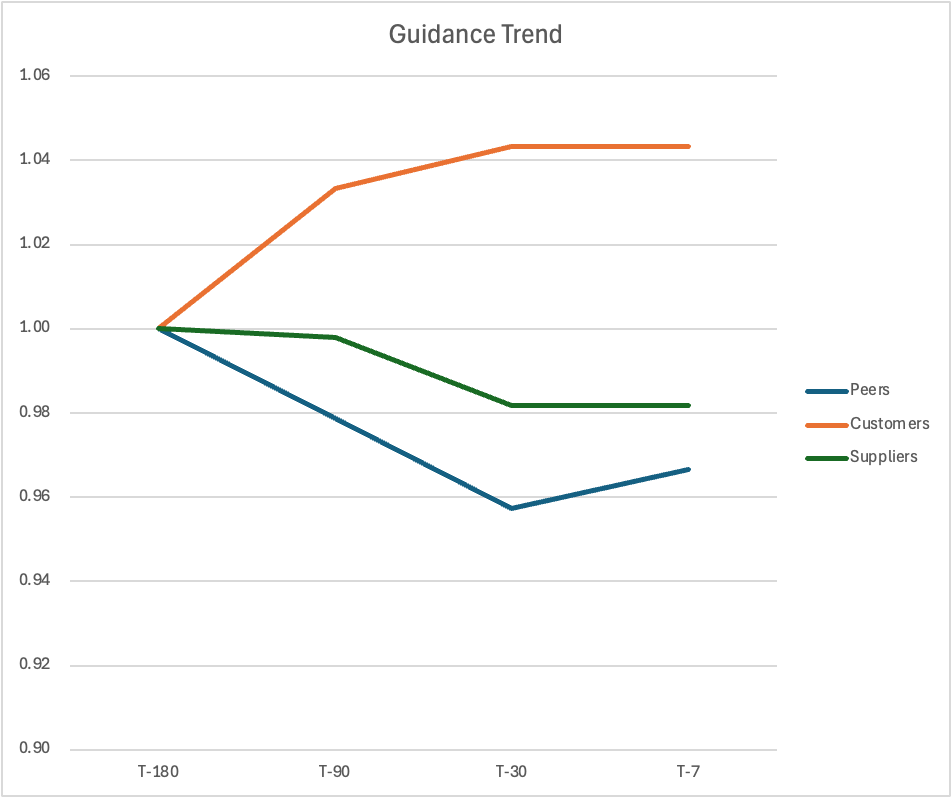

But numbers alone don’t tell the whole story. The IR team also has to keep a finger on the pulse of the industry, the economy, and the competitive landscape. What are peers saying? What are suppliers and customers signaling? Macro trends, regulatory shifts, even geopolitical events — all of these can change the game overnight.

Aligning with the Big Picture

And then there’s management’s vision. Guidance isn’t just a forecast; it’s a statement of intent. It needs to reflect where the company wants to go, not just where it is. The IR team has to balance optimism with realism, ambition with credibility.

The Reality Check: When Plans Meet the Real World

“The best laid plans of mice and men…” — yeah, that old chestnut. Once guidance is out there, the real challenge begins. Actual results rarely line up perfectly with expectations. Sometimes they’re better, sometimes worse. The IR team’s job? Keep a close eye on the numbers and be ready to course-correct.

If trends start to diverge, it’s time to craft a clear, honest message for investors. No one likes surprises, but everyone respects transparency.

The Wild Card: Change

The economy shifts. Industry conditions evolve. Competitors move. What was true last quarter might not hold this quarter. That’s the reality IR teams live in.

How IR Teams Navigate the Noise

Watch Your Peers, Customers, and Suppliers

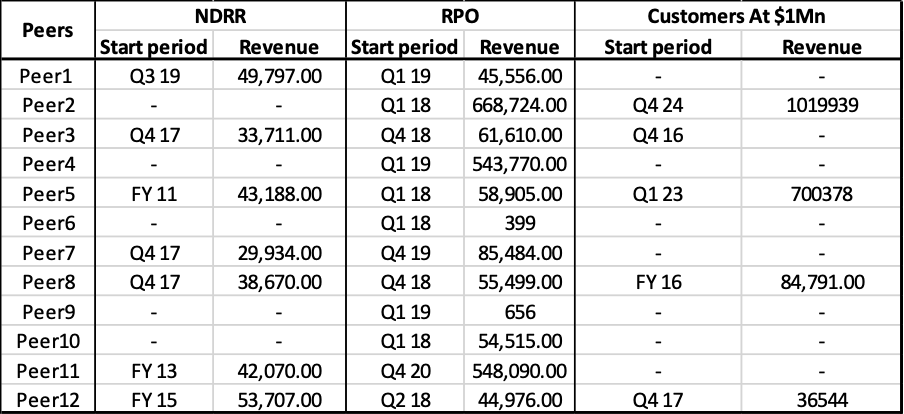

Tracking guidance changes and consensus estimates from companies connected to yours is like having an early warning system. If your peers are lowering their bars or if customers are signaling trouble, that’s a signal worth noting.

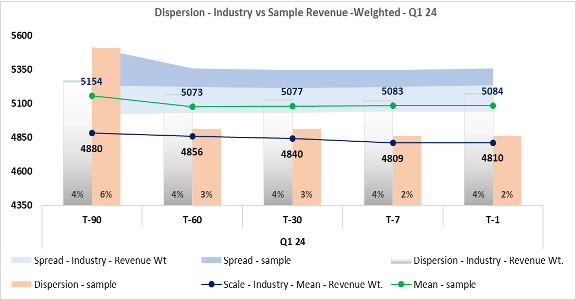

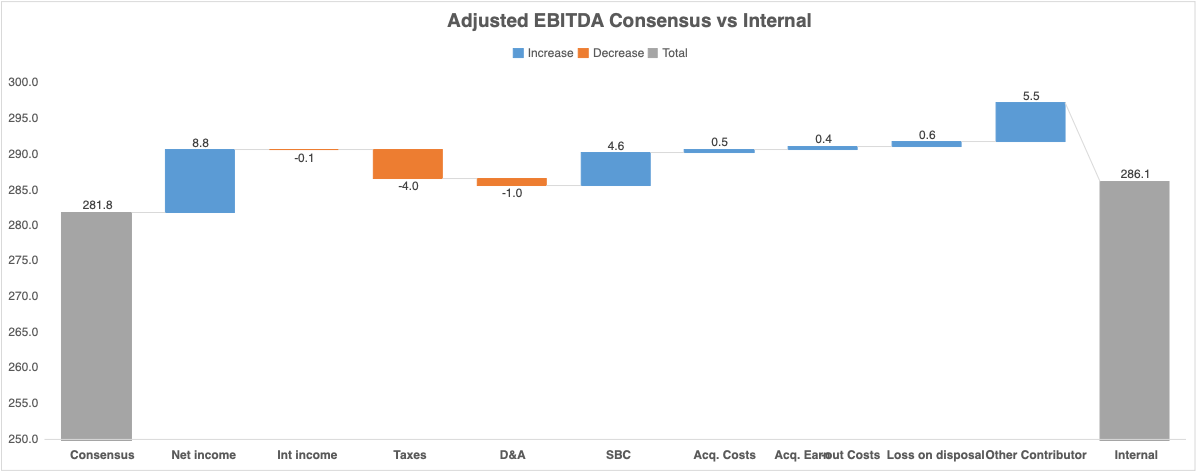

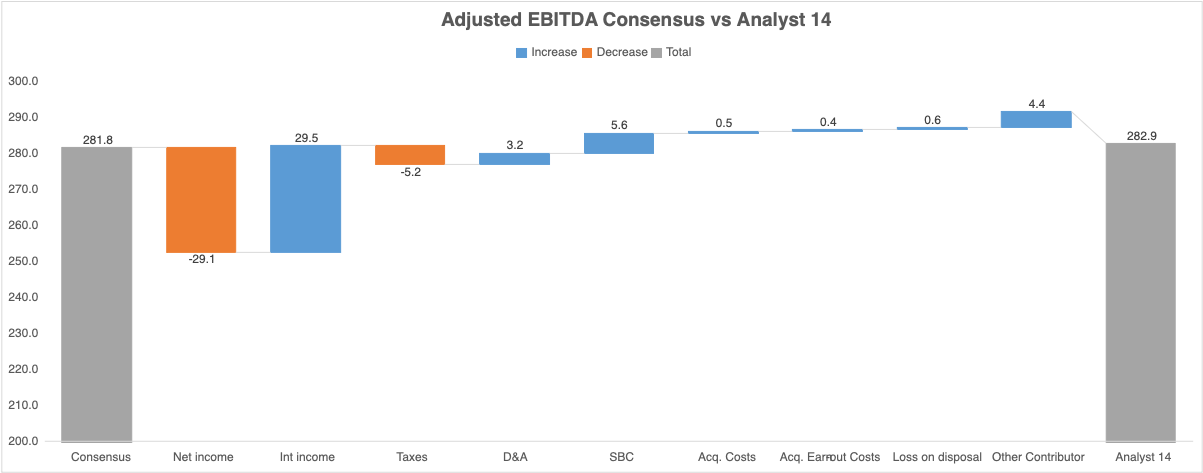

Model Check: Internal vs. Analyst Estimates

Building your own model based on analyst data and comparing it with your internal numbers can reveal blind spots. Where do estimates diverge? Which line items have the widest range of forecasts? Sometimes, a stable line item suddenly becomes unpredictable — why? Peers’ reporting patterns can offer clues.

- Understand where there might be deviation from analyst models to internal estimates

- Identify where there might be a lot of dispersion on a particular line item – this could be because there is no clarity on how to forecast that particular line item – an item that normally stable, but it is off for a particular period.

- Identify what line items peers who have lower dispersions are reporting and when they started reporting those line items.

Bring It Back Inside

Armed with external insights, the IR team can work with finance to adjust expectations and goals. It’s a two-way street — external signals inform internal planning, and internal realities shape external communication.

What’s next

Next week, we’ll dive into another layer of risk. But for now, if you see gaps in this approach or want to talk through your own challenges, reach out or drop a comment. The conversation is just getting started.