More dissonance in sell-side analyst coverage

There’s more to the sell-side than consensus numbers and quarterly notes. The real story is in the patterns, the outliers, the subtle shifts in tone and influence that shape how your company is perceived. For IR, tracking and measuring analysts isn’t just a checklist-it’s an ongoing process of identifying where the narrative diverges, and understanding who’s driving it.

Leader-Follower

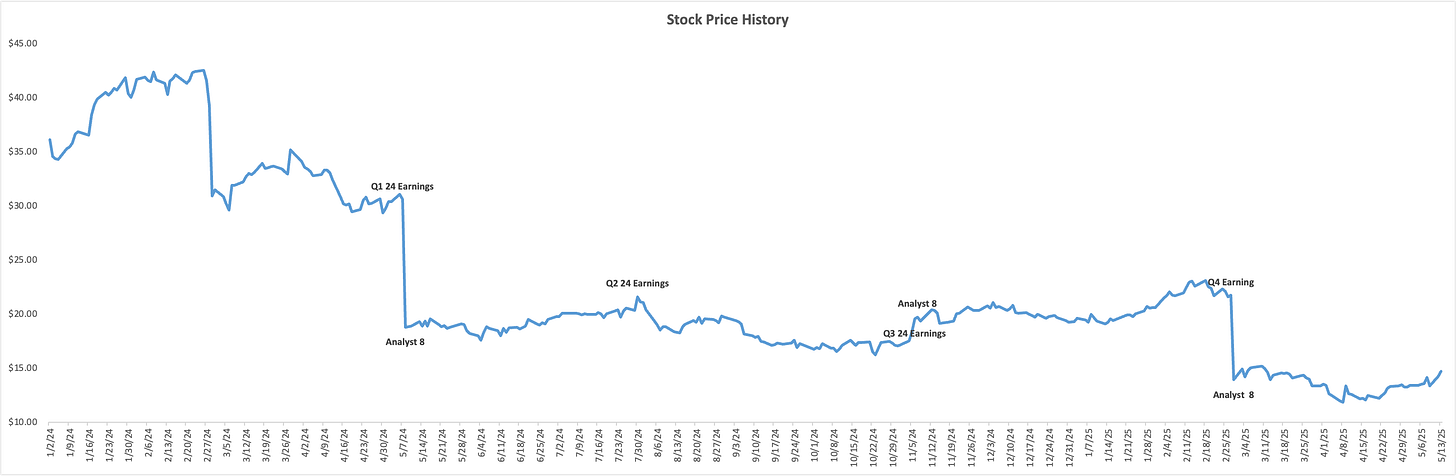

Not all analysts have the same impact. Some set the pace, releasing estimates first and shaping the initial market reaction. Others follow, echoing or challenging the consensus. It’s essential to know who’s leading: track whose commentary consistently moves the stock, whose estimates are closest to reality, and whose updates drive volume. When an influential analyst (say, Analyst 8) weighs in, that’s a signal to engage directly and ensure your message is clear.1

Thanks for reading! Subscribe for free to receive new posts and support my work.Subscribe

Earnings call dynamics: Decoding Tone and Themes

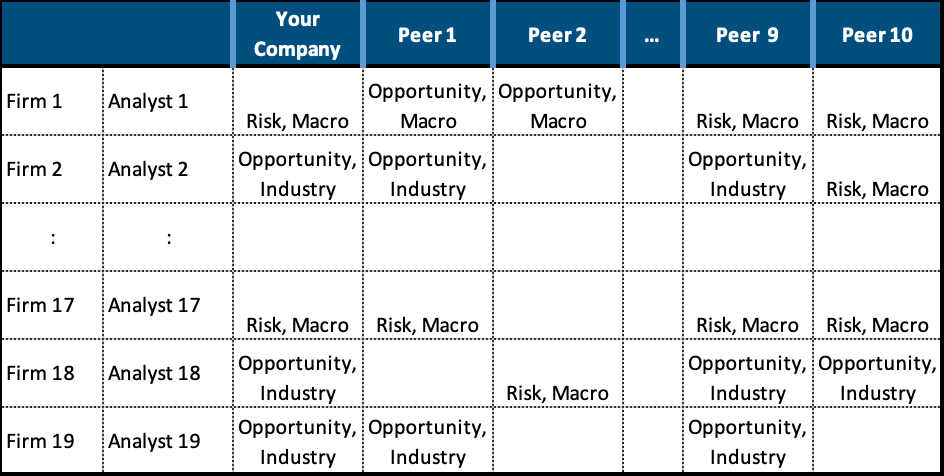

Earnings calls are more than Q&A-they’re a window into what analysts are really focused on. What questions are they asking your peers? Are the concerns about growth, risk, or broader industry issues? Track the themes, note the shifts in tone, and prepare for the questions that matter most. After each call, review how the narrative has changed and adjust your strategy accordingly.

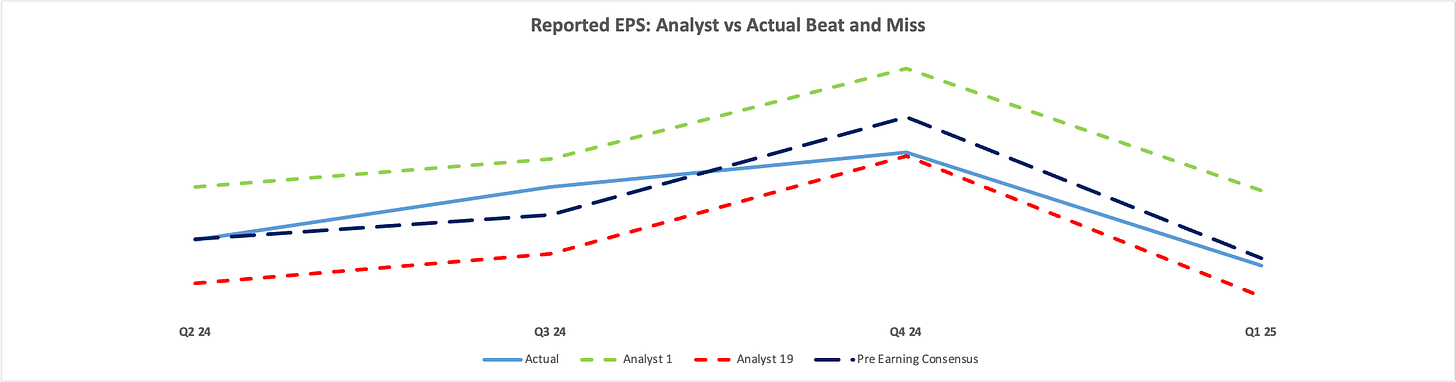

Estimate Accuracy History by Analyst

Patterns matter. Some analysts consistently overshoot, others underestimate. Track estimate accuracy by analyst and by line item. Who’s always at the low end? Where are the biggest misses? This data isn’t just for scorekeeping-it informs how you engage with each analyst and where you may need to clarify or reinforce your guidance.

Analyst engagement Measurement

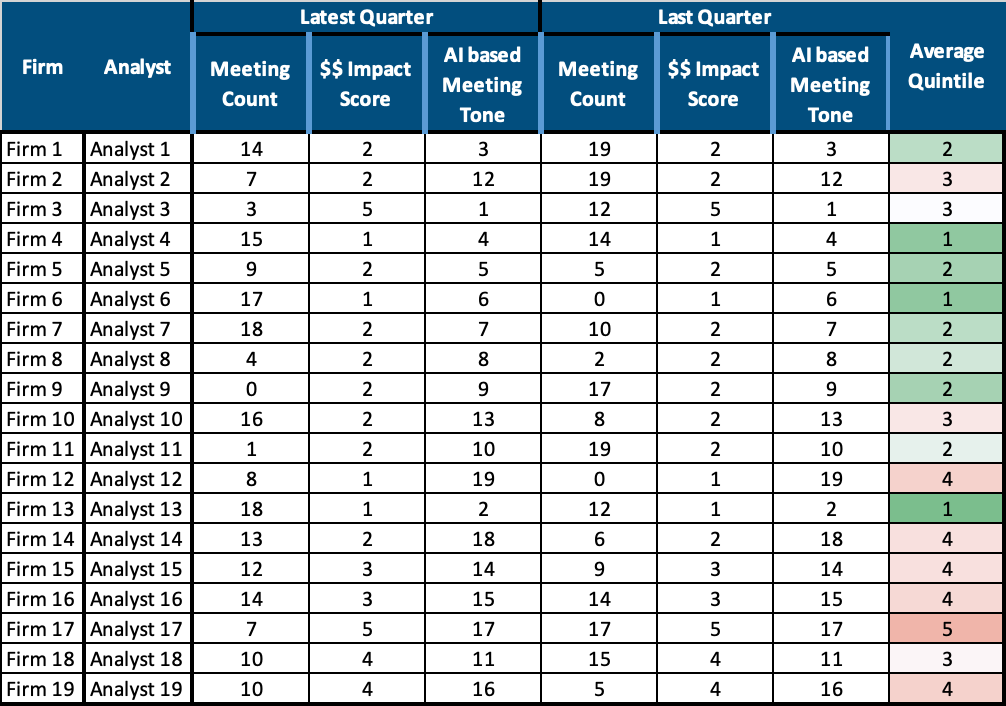

Analysts do more than publish reports-they connect your company to the investment community. Track the quantity and quality of meetings, conferences, and introductions. Not all interactions are equal: prioritize those who bring new investors to the table and foster meaningful engagement.

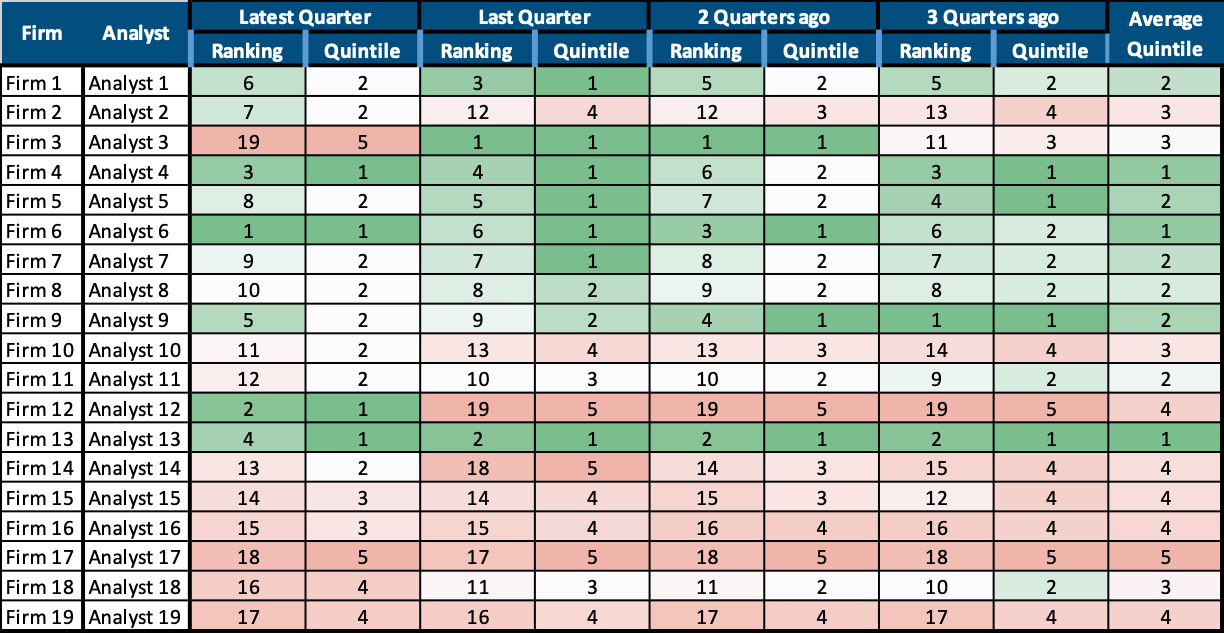

Ranking and Incentivizing Analysts

Develop a ranking system based on estimate accuracy, influence, and engagement. Reward the most insightful analysts with greater access to management and deeper conversations. This not only incentivizes diligence but also ensures your time is spent where it matters most.

Putting it all together

This is where technology elevates the process. AI can identify subtle shifts in sentiment, flag inconsistencies, and highlight emerging trends across analyst commentary and estimates. It’s about catching the points of dissonance-where market perception and your narrative diverge-before they become risks.

At Virtua, we see the sell-side as a complex, evolving landscape. Understanding it requires both quantitative rigor and qualitative insight. The value is in connecting the dots and anticipating where the next divergence might occur.

What’s next?

Next week, I’ll explore another dimension of risk. If you think there’s a blind spot in this approach, or want to discuss how we can help you identify and address your own points of dissonance, reach out or leave a comment. The conversation continues.