Understanding Take Private Transactions

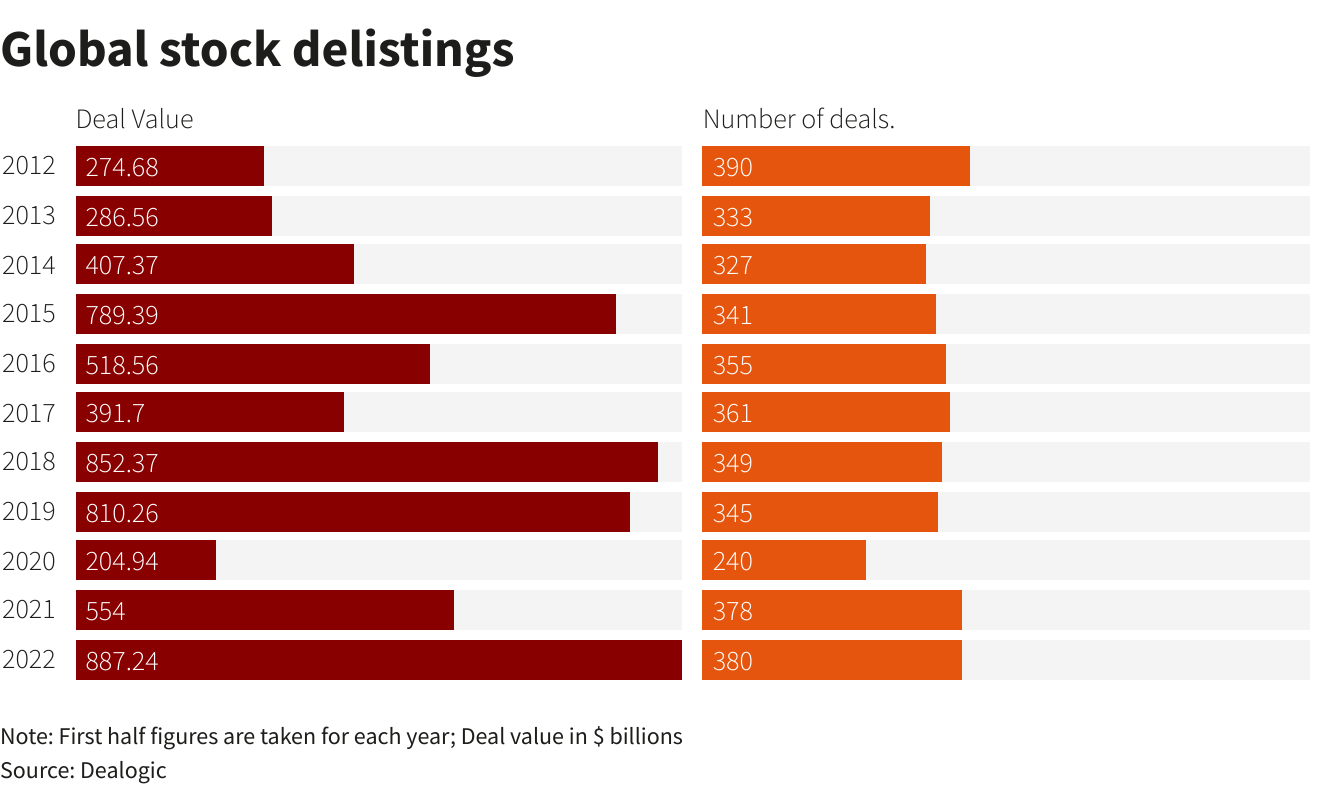

Have you ever heard of a company being taken private? Coupa is the latest example of a big name being de-listed from a stock exchange and purchased by a private equity buyer.

It’s becoming increasingly popular for companies to go private, especially when they are trading at “attractive” prices. So what exactly does a take private entail? And why does it happen?

The What

A take private is a transaction in which a publicly-traded company returns to private company status, generally as a result of a sale to one or more financial buyers. The buyer could be a strategic (Salesforce buying Slack), a private equity firm (Thoma Bravo buying Sailpoint), or an eccentric billionaire (Elon Musk buying Twitter).

The Why

There are many reasons why companies might choose to go private. One of the main benefits is that the company is no longer subjected to the scrutiny of being a public company. It’s tough being in the lime light. There are a lot of expectations around performance.

As a private company you can generally operate with less transparency, which can allow you to make decisions more quickly. This can be beneficial if the company wants to pursue a strategy that might not be popular with investors, or take a long time to materialize, such as a re-org.

Going private can also allow the company to take on greater debt, which in turn can provide more money for growth or other purposes.

Finally, taking a company private can allow the stakeholders to reap the benefits of a company without the cost of keeping everyone up to date. The administrative burden that goes along with reporting quarterly results is huge. There are entire departments of people at public companies focused legal and communication.

Real World Examples

Some of the most well-known companies that have been taken private include Dell, Toys R Us, and Burger King.

- In 2013, Dell announced that it would be taken private in a deal worth $25 billion.

- Toys R Us was taken private in 2005 in a deal worth $6.6 billion.

- Burger King was taken private in 2010 in a deal worth $3.3 billion.

At the top of this post is a larger sample from the tech world, which we used in the analysis below.

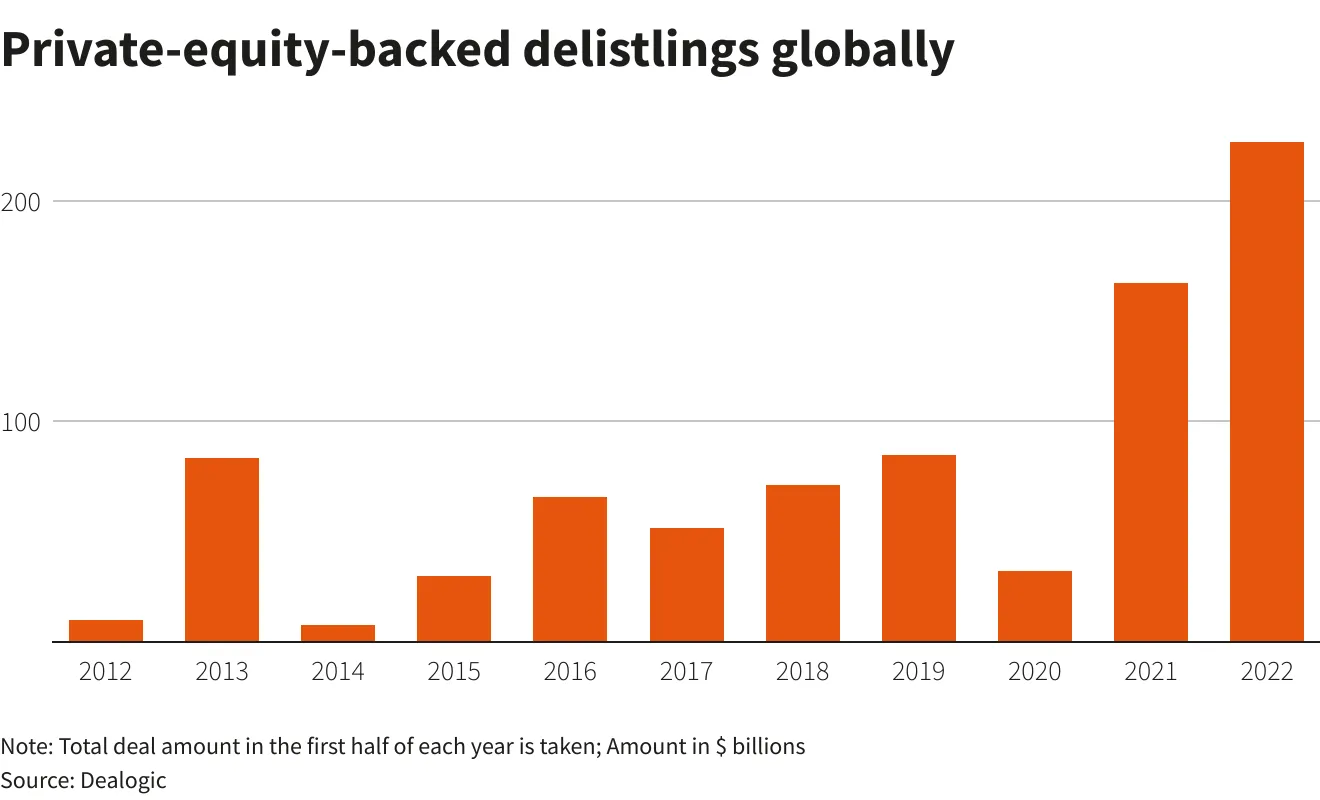

Private Equity Players

Private equity firms are often the ones that take companies private.

Some of the most active private equity firms in this area include Thoma Bravo, Vista Equity, KKR, Carlyle, and TPG Capital.

Together, these 5 firms have been involved in some of the biggest take private transactions in recent years.

Leading Indicators

I teamed up with our friends at Virtua to investigate the financial profiles of companies in the lead up to being taken private. They crunched the data from 50 tech take privates over the last decade using their powerful lifecycle analysis tool.

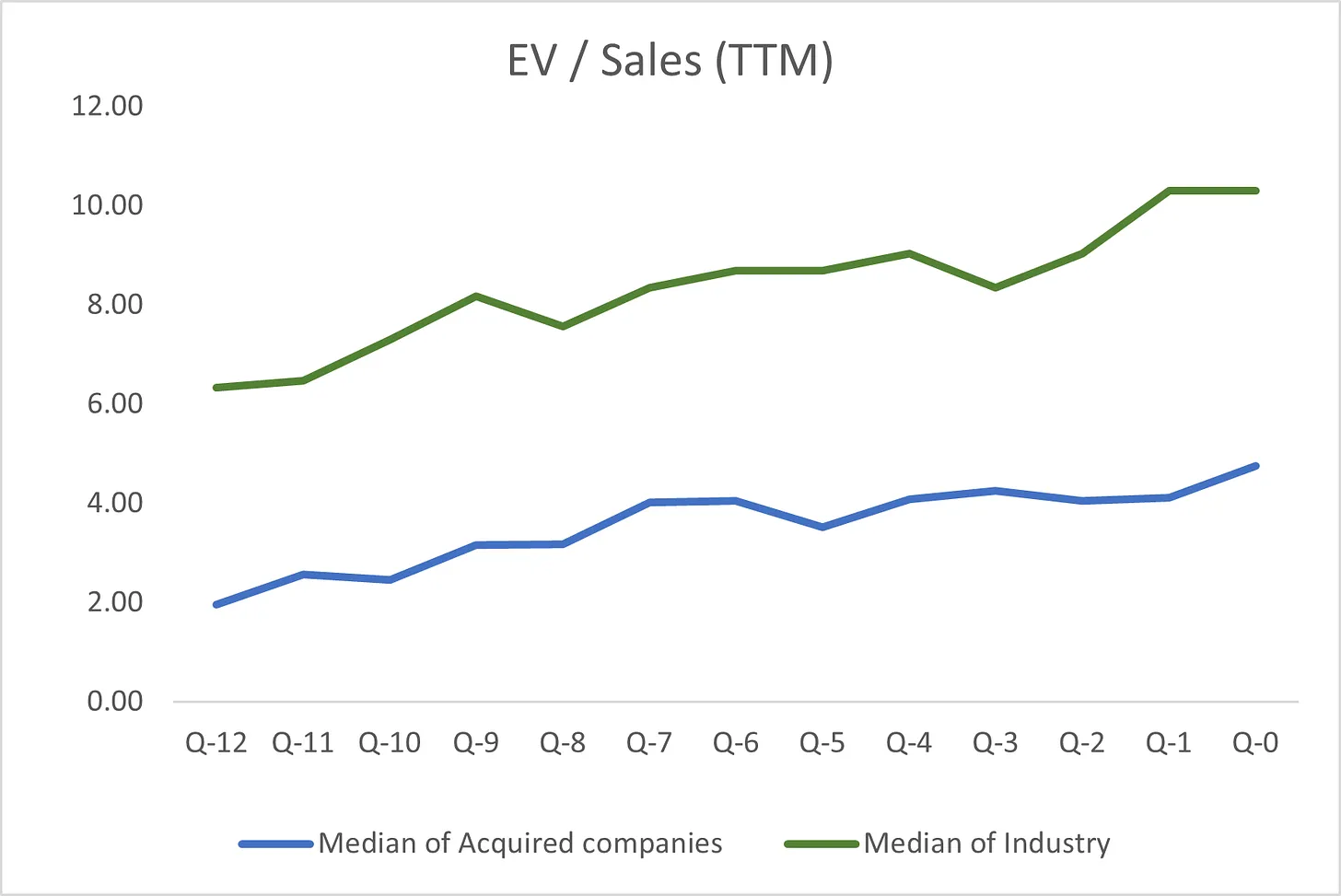

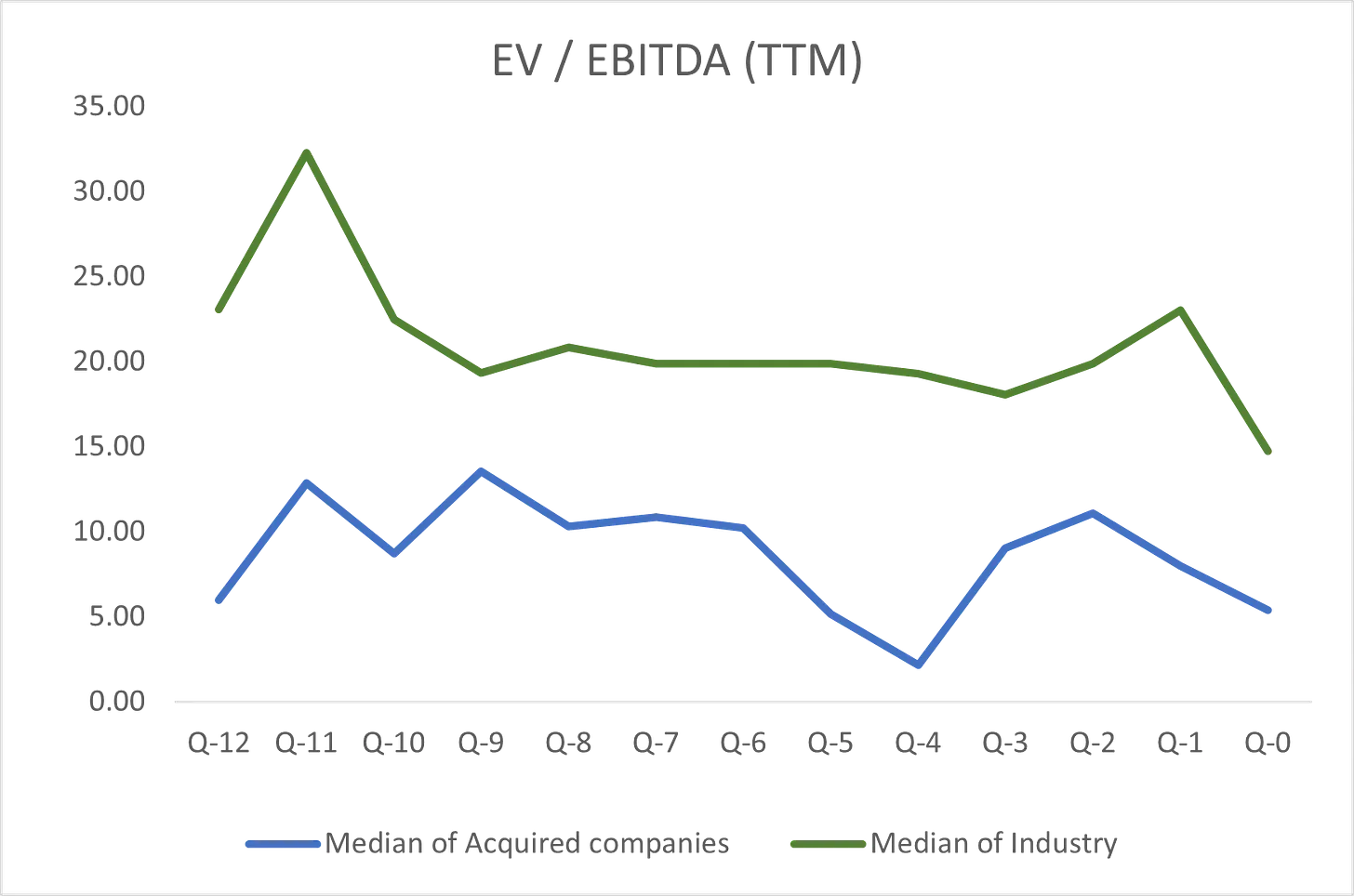

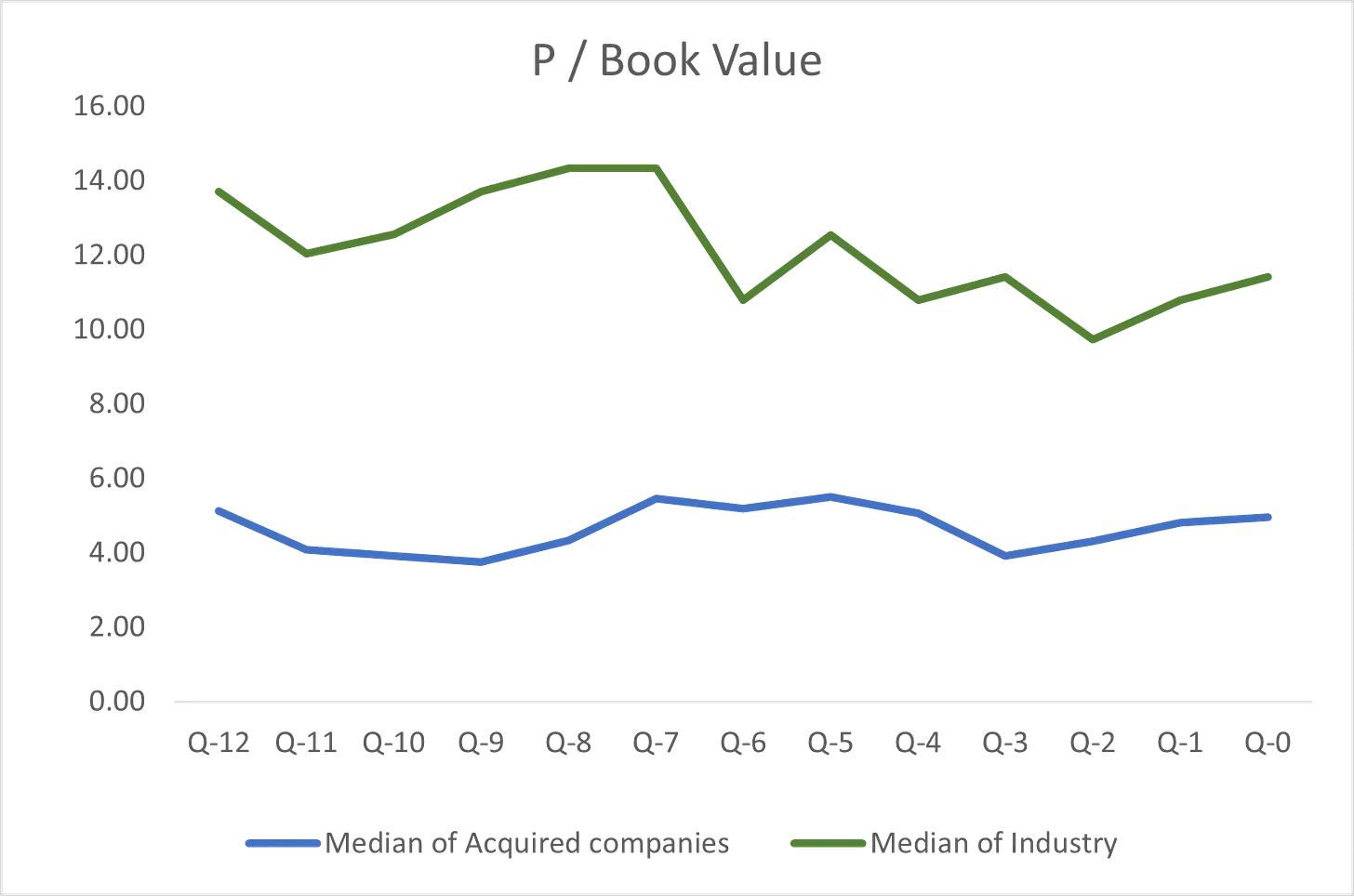

The charts below represent Take Private company performance vs Tech Sector performance, with Q = 0 representing the time of being taken private. This neutralizes for whatever the market volatility was at the time (also known as financial benchmarking voodoo).

Signal #1: Lower EV / Sales

- As a reminder, EV / Sales = Enterprise Value / Revenue

- Enterprise value is calculated as market cap plus its debt (total debt) less any cash and cash equivalents

- From an investor perspective, higher value of EV/Sales can be indicative of the “expensiveness” of the valuation of the company

- Conversely lower EV/Sales ratio is considered better investment opportunity as the company is considered undervalued (in relationship to its peers)

- A low EV / Sales may also indicate lower growth expectations, while a high EV / Sales may indicate that investors expect big things (and big growth)

- Takeaway: Companies with lower growth are in the cross hairs (single digit to high teens); especially those who were growing REALLY fast and slowed to medium fast

Signal #2: Lower EV / EBITDA

- Generally, the lower the EV-to-EBITDA ratio, the more attractive the company may be as a potential investment, as it spits out cash

- A low EV-to-EBITDA ratio could signal that a stock is potentially undervalued

- A lower EV/EBITDA means you’re spending less money for a $1 of earnings. So that’s a good thing

- Takeaway: Investors pony up for profitability, especially when it’s cheap.

Signal #3: Lower Price to Book Value

- Investors use the price-to-book value to gauge whether a company’s stock price is valued properly

- A P/B ratio of one means that the stock price is trading in line with the book value of the company

- A P/B ratio with lower values signals to investors that a stock may be undervalued

- In other words, if a company liquidated all of its assets and paid off all its debt, the value remaining would be the company’s book value

- Takeaway: The P/B ratio provides a valuable reality check for investors seeking growth at a reasonable price

Who Could Be Taken Private in 2023?

Potential names that have been floated include Peloton, Shake Shack, and AMC Entertainment.

The biggest potential headwind for take privates in 2023 – the cost of debt. Many take privates are financed with a heavy dose of debt. In fact, Twitter owes at least $1B annually in interest payments on the $13B in debt required to take it private.

But then again, rising interest rates do contribute to the stock market dips that make take privates a lot more appetizing… soo….

But, if I was a betting man (disclaimer: this is not financial advice, I just have a degenerate streak and like to watch the ponies run from time to time), I’d say SumoLogic.

But only time will tell.

Smart Stuff I Read at 2AM:

- Private Equity de-listings – Reuters

- Twitter debt – Press Herald

- EV / Sales – Full Ratio

- EV / EBITDA – Wall Street Prep

- P / B – Investopedia

What I’ve Been Reading

My buddy Matteo writes “Work3” – a weekly column on the changing nature of work.

He interviewed me on my career journey, starting Most metrics, and where I see the “future of work” going. Spoiler alert: I think people will increasingly see their networks as the businesses they work for, not the C corps themselves. More in the link below:

I’d recommend you give Work3 a subscribe for a fresh take on workplace evolution.

Quote I’ve Been Pondering

Every culture has its own way of teaching the same lesson: Memento mori, the Romans would remind themselves. Remember you are mortal.

-Ryan Holiday, The Obstacle is the Way